Cruising the Southern Caribbean by Hugh Darley IDEA Inc.

Unlike many destinations in the world, the Southern Caribbean has an opportunity to “define its own destiny” and enjoy tremendous growth potential from an already maturing cruise tourism industry through the development of a regional strategy. As the cruise industry continues to grow and expand its demographic reach and profile; the Southern Caribbean has a unique opportunity to capitalize on that growing market demand. The world geopolitical environment remains uncertain, but the Southern Caribbean is seen as a safe, yet exotic, destination for global travelers. Cruise Industry growth continues in Europe with South and Central America setting an even faster pace on its way to becoming a destination within reach for millions of new cruise travelers. The region has just now begun to see its potential as growing fleets of ships with returning guests looking for new and exciting itineraries and destinations close to home.

The Southern Caribbean region should seize the immediate opportunity to encourage significant long term capital infrastructure investments to rapidly expand its offerings before other global markets absorb expanding fleet inventories.

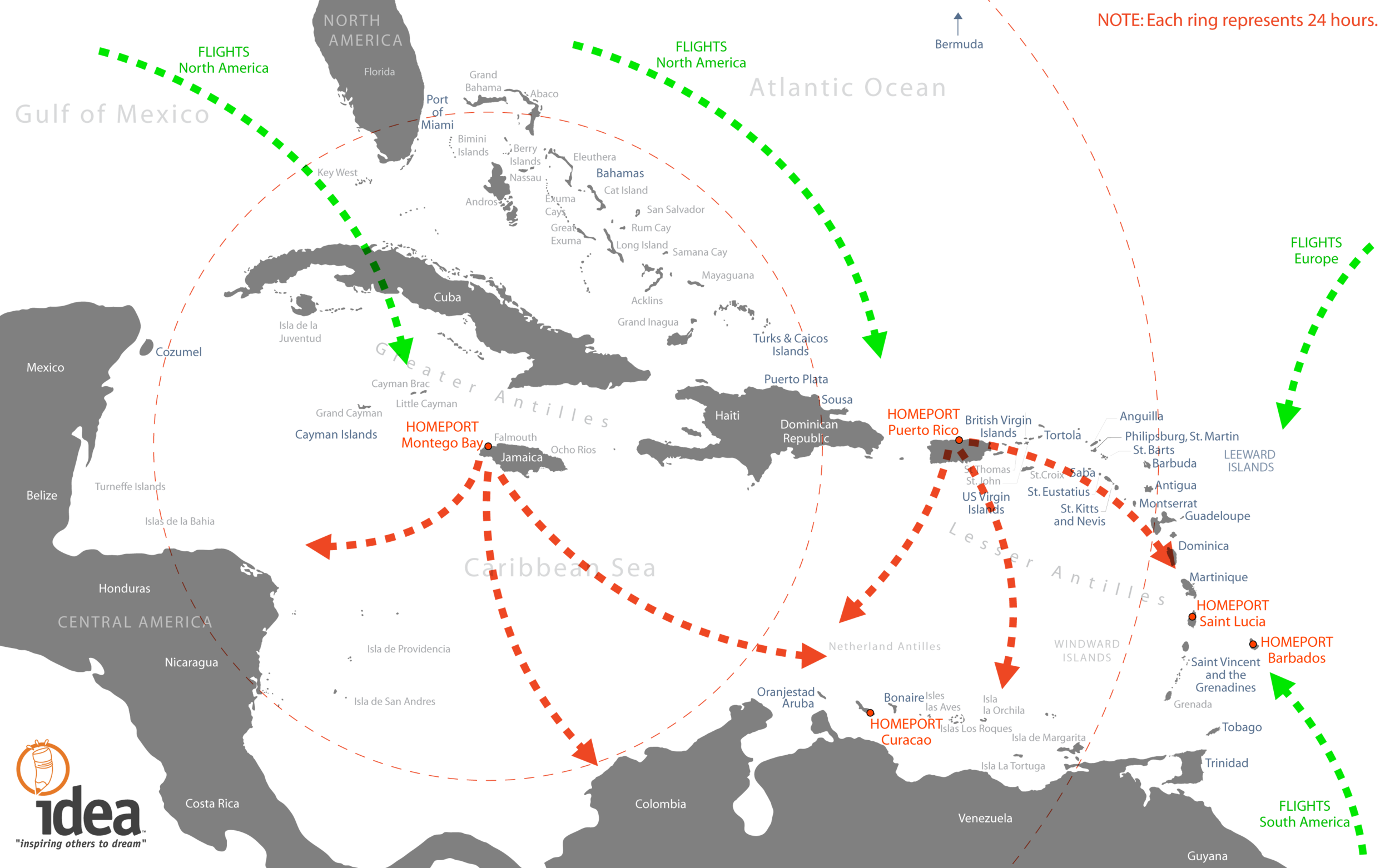

The center of the cruising world is expanding beyond the capacities of Miami, which should prompt more island nations to look for “home port” opportunities with significant airlift capacity to easily compete for global travelers. Barbados, St. Lucia, and Curacao are three such destinations with abundant air lift and deep water harbors. With older ship deployment to new markets, the need exists for cruise lines to make longer term commitments in new destination markets. In the absence of new commitments, ships may be repositioned to Asia, Europe, and South America for long periods of time. New ship builds coming on line in 2015 and 2016 with existing smaller vessels being redeployed to new markets, the Southern Caribbean must seize the time critical opportunity or possibly miss this wave of new deployment.

The region should also look to work with other ports of call in the Caribbean to move Home Ports that can reach Southern Ports in 7 day itineraries. Potential strategic Home Ports such as a new Montego Bay Jamaica and expanded San Juan allow Home Port vessels to reach every Southern Port in a seven day itinerary. The region should work with those existing Home Ports to expand and help develop a new Southern Caribbean Operating Theater as new ports are being developed in Barbados, St. Lucia, and Curacao. The region is poised for tremendous growth but must step up to the plate now with infrastructure development or wait for a future wave of new ship deployment.